Securing Your Future: The Ultimate Guide to Smart Retirement Planning by Age 30

When you’re in your 20s or early 30s, retirement might seem like a far-off dream, something that belongs to your parents or grandparents. But here’s the truth: starting your retirement planning early is one of the smartest financial moves you can make. The choices you make now can set you up for a comfortable, stress-free retirement later.

So, here’s what you must know about retirement planning by the time you hit 30, and how you can start making decisions today that will benefit you tomorrow.

Essential Retirement Planning Strategies for a Secure Future

1. The Magic of Compound Interest

Imagine this: you put a small amount of money into your savings account, and over time, it grows. That’s the power of compound interest. Essentially, it’s the interest on your interest. The earlier you start saving, the more time your money has to grow. For instance, if you start saving ₹5,000 every month at the age of 30, you’ll have a substantial amount by the time you retire, thanks to the magic of compound interest. Even a modest amount can grow into a significant sum over decades.

2. Set Clear Retirement Goals

Before you dive into saving and investing, it’s crucial to have a clear idea of what you want your retirement to look like. Do you envision yourself living in a cozy hill station, traveling the world, or simply enjoying a quiet life at home? Your goals will determine how much you need to save. Calculate your expected expenses and desired lifestyle to get a sense of the amount you need to accumulate. Remember, the more specific you are with your goals, the easier it will be to plan for them.

3. Start Building Your Emergency Fund

An emergency fund is your financial safety net. It’s crucial to have three to six months’ worth of living expenses saved up in a separate account, so you’re prepared for unexpected situations like medical emergencies or job loss. This fund prevents you from dipping into your retirement savings when life throws you a curveball. Think of it as a shield protecting your future.

4. Leverage Retirement Accounts

In India, we have several options for retirement savings, such as the Public Provident Fund (PPF), Employees’ Provident Fund (EPF), and National Pension System (NPS). Each of these has unique benefits:

– PPF: This is a long-term savings scheme with tax benefits, a fixed interest rate, and a 15-year maturity period. It’s perfect for a risk-averse investor.

– EPF: If you’re employed, a portion of your salary goes into EPF, which grows with interest. It’s a great way to save for retirement without extra effort.

– NPS: This is a voluntary, long-term retirement savings scheme with tax benefits. It offers a mix of equity, corporate bonds, and government securities, giving you the potential for higher returns.

Understanding and utilising these accounts can significantly boost your retirement savings.

5. Invest Wisely

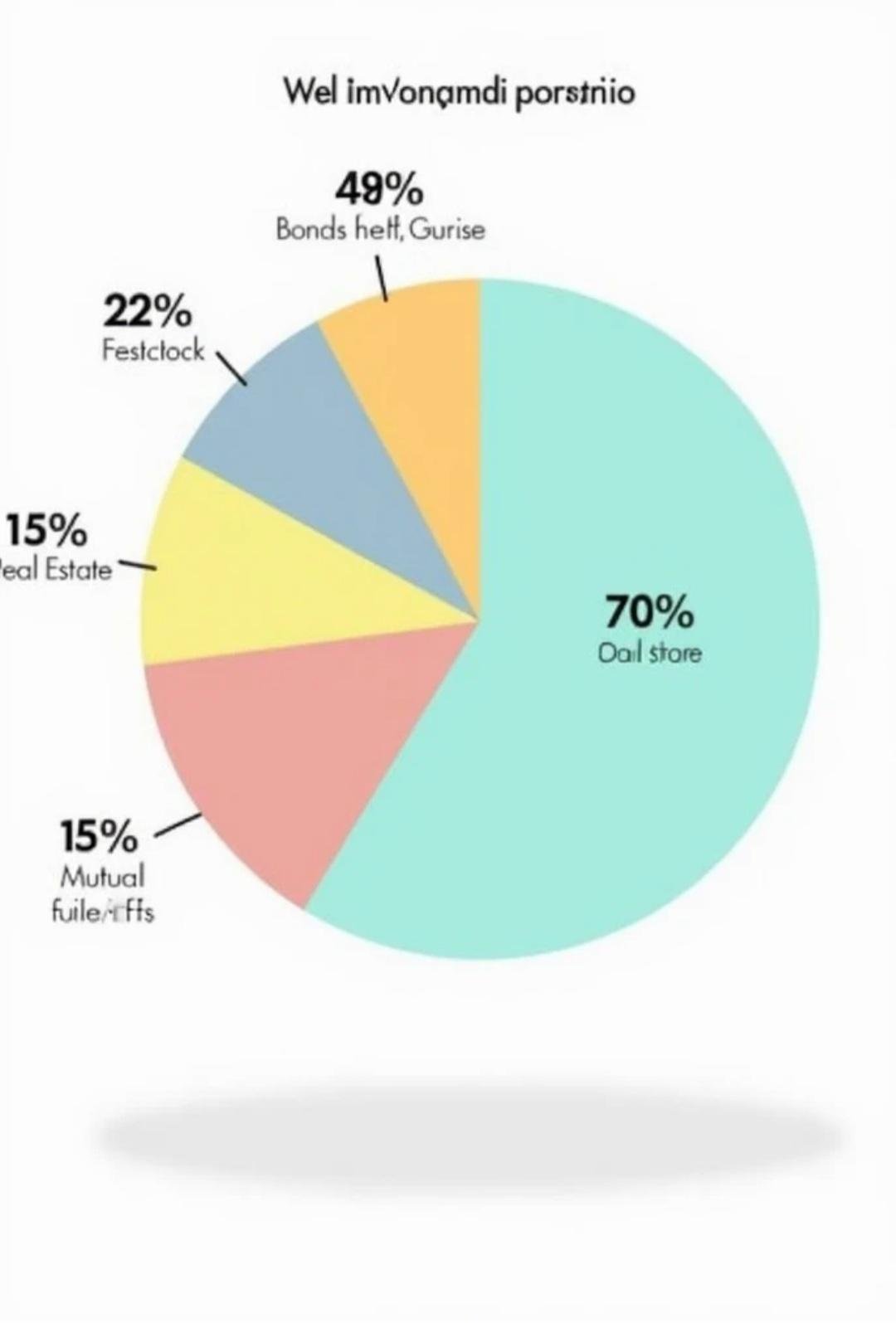

Saving is only part of the equation; investing is where the magic happens. Consider diversifying your investments to balance risk and reward. Equities, mutual funds, and real estate can offer higher returns compared to traditional savings accounts. However, they also come with higher risk.

For a balanced approach, you might allocate a portion of your savings to high-risk, high-return assets like stocks and the rest to safer investments like fixed deposits or government bonds. This way, you can grow your wealth while managing risk.

6. Plan for Inflation

Inflation erodes the purchasing power of your money over time. What costs ₹1,000 today might cost ₹2,000 in 20 years. To combat this, ensure that your retirement savings and investments grow at a rate that outpaces inflation. This often means focusing on investment options that offer higher returns.

7. Consider Tax Implications

Tax planning is an essential aspect of retirement planning. Make the most of tax-saving options like deductions under Section 80C for PPF and EPF contributions. Additionally, investments in certain schemes can offer tax-free returns. Understand how your retirement income will be taxed and plan accordingly to minimize your tax liability in retirement.

8. Regularly Review and Adjust Your Plan

Life is dynamic, and so are your financial needs. Regularly review your retirement plan to ensure it aligns with your goals and circumstances. Adjust your contributions, investments, and strategies as needed. Life changes like marriage, having children, or a career shift can impact your retirement planning, so stay flexible and proactive.

9. Get Professional Advice

Retirement planning can be complex, and seeking advice from a financial advisor can be invaluable. They can help you navigate investment options, tax strategies, and retirement planning in a way that’s tailored to your specific needs. A good advisor can also provide insights into market trends and help you make informed decisions.

10. Stay Disciplined and Consistent

Finally, the key to successful retirement planning is discipline. Commit to your savings plan, avoid dipping into your retirement fund for non-emergencies, and stick to your investment strategy. Even if it feels challenging, staying disciplined will pay off in the long run.

Unique Retirement Strategies You Rarely Hear About

1. Geographical Arbitrage: Retiring in a Low-Cost Country

One of the most overlooked strategies is retiring in a country with a lower cost of living. This concept, called geographical arbitrage, allows you to stretch your retirement savings further. Researching countries where your savings will last longer can be a smart early consideration.

2. The Importance of Emotional Preparation for Retirement

Financial planning often overshadows the emotional aspect of retirement. However, transitioning from a structured work life to retirement can lead to identity crises or feelings of purposelessness. Start considering now how you’ll spend your time, find fulfillment, and build a social network post-retirement.

3. Risk of Lifestyle Creep

As you advance in your career, you might start earning more, but that often leads to spending more—a phenomenon known as lifestyle creep. By age 30, it’s crucial to keep this in check, ensuring that any salary increases are channelled towards savings and investments, not just better lifestyle upgrades.

4. Investing in Non-Traditional Assets

While most retirement portfolios focus on stocks, bonds, and real estate, non-traditional assets like art, antiques, or even intellectual property can provide unique revenue streams in retirement. Starting these investments early could provide lucrative, alternative income sources later in life.

5. Guarding Against Cognitive Decline

Few people think about how cognitive decline can affect their financial decision-making in retirement. Setting up systems early, such as power of attorney or trusted financial guardians, ensures that your assets are managed well even if you’re unable to make decisions yourself in later years.

6. Plan for Intergenerational Wealth Transfer

If you aim to leave a legacy or financial resources for your children or other family members, you’ll need to plan early for intergenerational wealth transfer. This includes setting up trusts, tax-efficient inheritance strategies, and safeguarding your estate to ensure it’s passed on according to your wishes.

7. Retirement Inflation: Planning for a Higher Retirement Cost

Your expenses in retirement might actually increase over time due to inflation, increased healthcare costs, or lifestyle changes. Many people underestimate the compounding effect of inflation, especially over decades. Planning for a retirement budget that factors in potential cost increases is a lesser-known but crucial consideration.

8. Leveraging the Power of Side Hustles

Starting a side hustle in your 30s could have massive long-term retirement benefits. It not only provides additional income that can be invested for retirement but also gives you a potential fallback career option once you retire from your main job.

9. Creating a Legacy Beyond Wealth

Retirement planning isn’t just about securing your finances but also about thinking of the legacy you want to leave behind. This could mean early involvement in charitable giving, mentorship, or creating projects that last beyond your lifetime, all of which require intentional planning.

10. Aligning Retirement Plans with Personal Growth

People often forget to align their retirement plans with personal goals outside of finances. For instance, if you wish to retire to focus on learning new skills, hobbies, or even go back to school, these non-financial goals need to be factored into your retirement strategy early.

Planning for Health and Longevity

Ensuring a long, healthy retirement involves more than just saving money; it requires proactive planning and preparation for health and lifestyle changes. Here’s a concise look at essential areas to focus on:

1. Investing in Preventive Health Care

– Regular Check-Ups: Schedule routine health screenings to catch potential issues early and manage chronic conditions effectively.

– Vaccinations: Stay current with vaccines like flu shots and shingles to prevent serious illnesses.

– Healthy Lifestyle: Adopt a balanced diet, exercise regularly, and get adequate sleep to maintain overall health and reduce disease risk.

2. Planning for Long-Term Care Needs

– Long-Term Care Insurance: Consider purchasing insurance to cover future costs of nursing homes or in-home care.

– Dedicated Savings: Set aside funds specifically for long-term care to protect your assets.

– Caregiving Options: Explore various caregiving options, including family, professional, and community services.

3. Addressing Cognitive Health and Memory Care

– Mental Stimulation: Engage in activities like puzzles and social interactions to keep your mind active and sharp.

– Legal Preparations: Prepare documents like a living will and power of attorney to manage your affairs if needed.

– Memory Care Services: Research facilities and services for dementia or cognitive impairments in advance.

4. Building a Support Network

– Family and Friends: Maintain strong relationships with loved ones for emotional support and practical help.

– Community Resources: Join local organizations and social groups to stay connected and supported.

– Professional Help: Seek advice from financial and healthcare professionals to aid in planning and managing your retirement.

5. Preparing for Lifestyle Changes and Adaptations

– Home Modifications: Make your home safer with features like grab bars and ramps to accommodate mobility changes.

– Downsizing: Consider moving to a smaller, more manageable living space if maintaining your current home becomes difficult.

– Adaptive Technologies: Use technologies like smart home devices and mobility aids to enhance independence and quality of life.

Conclusion

Retirement planning isn’t just for the older generation—it’s something you should start thinking about by the time you’re 30. By harnessing the power of compound interest, setting clear goals, building an emergency fund, leveraging retirement accounts, investing wisely, planning for inflation, considering tax implications, reviewing your plan regularly, seeking professional advice, and staying disciplined, you can set yourself up for a secure and comfortable retirement.

The choices you make now will shape your future, so start planning today. It’s not just about saving money—it’s about creating a future where you can enjoy the fruits of your labor, pursue your passions, and live comfortably. Start early, stay informed, and take control of your financial future. Your future self will thank you.